All the information in this letter is not to be considered financial advice; it is the author’s personal views and agreed views of others from their overviews of present markets,

Some of the content will be a summary of articles I have read and believe the author got most or all of it bang on, some will be statistics that have been check for validity, but all will be content I believe is of use or interest to margincall.club members.

Hello to all Club members, and for the moment anyone else that comes to the site because the members access only side is yet to be set up but is well on its way.

Plus we have just partnered with Tangem wallet for a 10% off offer when you use the link on the home page.

There is also a chance to win a Tangem wallet when you use our exchange affiliate link in a monthly draw.

Access will come free with full club membership when you use one of or partner exchanges to trade.

Welcome to the February 2024 edition of the margincall.club FinTech Newsletter.

This month as last, I will provide you with an overview of key financial events and market developments from the past month (January) and what effect those events could have in February, Our goal is to help you stay informed and to make your own well-informed decisions.

I will also visit any of the price predictions given in the December 2023 letter to see what played out and what didn’t and why.

Financial Market Highlights:

- Stock Market:

There is still some scepticism in markets of reported government figures across the board which is continuing to cause some jitters with traditional markets, this could continue to add to a fall in the traditional markets into the first week of February.

As I stated in last month’s letter I saw a 2 to 3% drop in markets, that played out with all the major stock markets, all are in negative territory for January 2024. The Nasdaq leads the retreat, down 3.3%, the Hang Seng is off 3%, the FTSE 250 2.7% and AIM 100 2.7%. Historically, January is the worst of all months for shares since 2000 and I see that continuing, it things escalate in the gulf expect that February figure to be knocking on the 5% door

- Economic Indicators:

Beware the hawks of war! Strike’s in the gulf will see Iran and the Yemen up the attack game, when you can attack a $50 billion aircraft carrier or a $50 million tanker with a $50k missile and do damage, or even sink, then that one missile will do more damage to markets, and I have seen evidence of leverage trades 24 hours before attacks happen, makes you think who is paying for the hardware!

- Cryptocurrency Update:

In December I was of the mind that Bitcoin would get very close to >$48k< around the New Year and it got to £46.2K in December, so with hind sight I should of said the 11th January 2024, timing the market is not a science!

I remain bullish on Bitcoin, the ETF outcomes will play out as we move through February, I stand by the 50K will come fast and furious when the supply shock hit’s.

I did say “the end of January could see a new all-time high for Bitcoin” that was a typo due to uploading a copy that did not have the full corrected paragraph in, and a number of people picked up on it, it should of read April, around halving date, and history tells us that when the halving hits that rodeo starts!

- Commodities and Forex:

I don’t provide updates in this letter on commodities like oil, gold, and Fiat currencies as these are assets that are affected by market trends and all the above.

Investment Insights:

- Market Analysis:

I stand by what I said last month on this, keep one eye on El Salvador and Argentina in the approach to giving more credence to Bitcoin in the day to day use in both countries.

Also fiscal digital transfer service in the African sub-continent will be a deal this year, expect any service looking to promote these services will do well till year end.

- Investment Strategies & Featured Asset:

Nothing has changed here from last month, my Macro view is you want to have a foot in both traditional and crypto markets and you have to look at data miners and companies like Micro strategy, the miners can switch to data storage and Micro Strategy will most probably capitalise some Bitcoin to cover costs of purchase if BTC goes >4X as that would be prudent.

If you see any ATM company looking to use those machines when idle to mine Bitcoin or a company that is using renewables, solar, water and wind to power miners all would be worth doing Due diligence to see if they are investable.

Plus any deals you hear about between Ai and data storage companies would be worth due diligence time.

Financial News:

- Global Financial News:

As started in the December and January letters, we have had other parties joining the war in the red sea, so we are going to see the US and other markets suffer that rely on that supply chain route.

These actions will only see pressure on interest rates across US, Euro and the UK which could see the stock market rise against the predicted down trend, that could lead to a catastrophic share fall next month that would lead to the cascade collapse of market positions,

Covered most of the news that could have impact market movement last month and they remain the same, those facts remain around the events in Ukraine, Gaza and Iran, escalation there could see a chain reaction in events and that moving US markets down and we have seen US personal killed in the last few days which have yet to see a response, that could be a pivotal action to escalate conflict.

1. **Interest Rate Rises Slow Down – But More Still to Come:**

Expect a dovish presentation from the feed two months before they start to drop interest rates. Watch the numbers on this, the fed state what data they use google it to educate yourselfs.

2. **Food Prices will rise in 2024 more than inflation:**

– Global food prices are expected to stay elevated in 2024 due to factors like drought, excessive rain, the war in Ukraine, and Gaza plus high energy costs impacting global farm production.

– The politicians have run out of smoke and the mirrors are broken, western countries that have only experienced single figure inflation are now experiencing inflation in the >20%< range on consumer edible’s, people are seeing those price increases and shrinkflation (the producers art of reducing the amount in a packet and still making look the same!) the only way to reduce that is less tax on the costs of transport and in the supply chain, which means reduction in tax income which inturn means more cow bell!

I would add to this that companies will exploit “Shrinkflation” in products, less product same price strategies!

- Regulatory Updates:

News on ETH ETF’s expected in weeks (maybe May as the ruling says “By May 11th”)

Personal thoughts:

I said last month about ETH hitting 0.06BTC, 0.06BTC ETH did show its face in january, unfortunately Bitcoin did not oblige with 60k, a lot of that was my interpretation of the grayscale holders that moved quickly to leave grayscale and the percentage that didn’t put that money into the other ETF’s and just took the profit, and the quirks of US tax laws, having now read up on them I still believe Bitcoin will hit the 50k before the halving.

If the Bitcoin ETF’s get sanctioned by Gary on the 11th May then Bitcoin could hit $60K+ by the end of May, never forget Eth has in its time been over 0.15BTC per ETH, I would not be surprised to see Eth at 0.25BTC before the end of 2025.

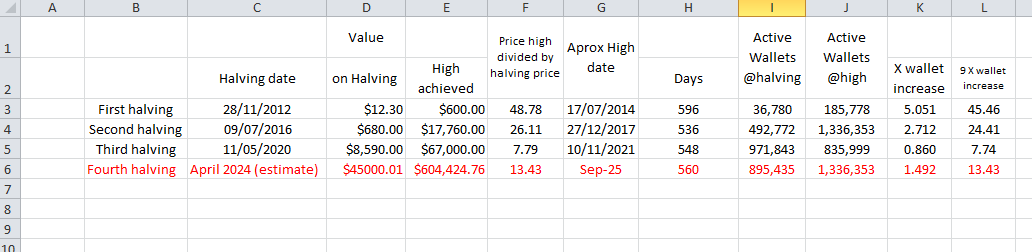

As you may know I am “the numbers guy”, and I am always looking at the numbers, over the holiday’s I was looking at figures around the halving and wallet adoption to see if there was any correlation, and I found somethings of interest, the main one was that it would seem the multiple increase in Active wallets from halving to price top multiplied by >9< would seem to indicate what top Bitcoin will top out at.

Below is a image of a simple excel document I am working on to test that theory, and the red is a predicted Bitcoin price top based on if active wallet highs in 2025 equal the 2017 all-time active wallet highs.

It is all based on historic figures and movement and requires more work as it has a >7%< discrepancy so additional data would help to prove or disprove, but it does seem to confirm Plan B’s 2025 price prediction which is a little spooky! The red figures are the predicted numbers based on previous bull market numbers.

There is the Having dates, and D is Bitcoin >price< at that date, E is the >high< of that bullrun, F is the high divided by Bitcoin value on halving day, G is the>date< E price was taken from Glassnode, H is the number of days it took to get to it’s high from the halving day, I is the active wallets on halving day, J is number of wallets on approx high date, K is J divided by I to evaluate Metcalfe effect, K appears to correlate to price if a multiple of 9 is applied on all halving’s to date.

I do believe there is more relevant data to add, but that I think will only confirm the trend shown!

To join the margincall.club click here and join one of our partner exchanges and get all the indicators shown on that page and a chance to win a Tangem wallet free.

To Connect on “X”:

Don’t miss out on our future newsletters and the club website updates. Subscribe today and follow us on “X” @margincall10 .

Thank you for trusting us with your information. We look forward to providing you with valuable insights in the coming month.

Regards to all and have a safe and happy New Year, leave your thoughts and views on X @margincall10 .

James,

Superb layout and design, but most of all, concise and helpful information. Great job, site admin.