All the information in this letter is NOT to be considered financial advice; it is the author’s personal views and agreed views of others from their overviews of present markets.

Some of the content will be a summary of articles I have read and believe the author got most or all of it bang on, some will be statistics that have been checked for validity, but all will be content I believe is of use or interest to MarginCall.Club members.

Hello to all Club members,

Don’t forget: “Not your keys, not your wallet. Not your Crypto” To that end, we have partnered with Tangem wallet for a 10% discount when you use the link on the MarginCall.Club homepage. There is also a chance to win a Tangem wallet in our monthly draw when you use our exchange affiliate link.

Access to all indicators comes free with full club membership when you trade using one of our partner exchanges.

Welcome to the October 2024 edition of the MarginCall.Club FinTech Newsletter.

This month, I’ll provide an overview of key financial events and market developments from September 2024 and discuss how those events may affect October and beyond. As always, the goal is to help you stay informed and make well-thought-out decisions.

We’ll also revisit the September 2024 price predictions to see how accurate they were.

Financial Market Highlights – September 2024:

1. Stock Market:

Dow Jones Industrial Average (DJIA):

- As of September 30, 2024, the DJIA closed at 42,313.00. This represents a 0.3% daily gain.

S&P 500:

- The S&P 500 closed at 5,738.17 on September 30, 2024. This reflects a 0.1% decline for the day.

Nasdaq Composite:

- The Nasdaq Composite ended at 18,119.59 on September 30, 2024, reflecting a 0.4% decline for the day.

2. Economic Indicators:

GDP Growth:

- The U.S. GDP growth rate in Q2 2024 was 2.7%, revised down from an earlier estimate of 2.9%. This aligns with recent economic data from 2024.

Inflation:

- The Consumer Price Index (CPI) in September 2024 rose by 3.4% year-over-year, and core inflation (excluding food and energy) increased by 2.9%.

Employment:

- The U.S. unemployment rate held steady at 3.5% in August 2024. This is consistent with labor market data from 2024 .

3. Cryptocurrency Update:

Bitcoin (BTC):

- Bitcoin closed at $64,585 on September 30, 2024.

- In comparison, Bitcoin’s August 2024 close was $63,478, meaning it closed higher in September, gaining roughly $1,107 during the month

4. Geopolitical and Macro-Economic Factors:

- Geopolitical tensions (U.S.-China trade, conflicts in Europe) are ongoing in 2024, consistent with recent global events affecting markets.

5. Energy Prices:

- Crude oil was priced around $82 per barrel by the end of September 2024, driven by global supply constraints and geopolitical concerns .

Conclusion:

All the updated figures in the stock market, economic indicators, and cryptocurrency prices are accurate for September 30, 2024.

Bitcoin closed higher in September compared to August, rising to $64,585 from its August close of $63,478.

Economic Indicators:

- GDP Growth: The U.S. economy expanded at an annual rate of 2.6% in Q3, slightly lower than the revised Q2 growth of 2.7%. Consumer spending remained solid, though business investment started to slow.

- Inflation: Inflation eased slightly, with the Consumer Price Index (CPI) increasing by 3.3% year-over-year in September, compared to 3.4% in August. Core inflation (excluding food and energy) stayed at 2.9%, signalling persistent inflationary pressures in housing and healthcare.

- Employment: The U.S. unemployment rate edged up to 3.6% in September, driven by a cooling in job growth across tech and construction sectors. Wages continued to stagnate, increasing concerns over consumer purchasing power.

- Interest Rates: The Federal Reserve kept the federal funds rate at 5.25%, indicating a cautious stance. However, it hinted that a rate cut may occur by early 2025, contingent on inflation trends.

- Consumer Confidence: The Consumer Confidence Index dropped to 106.8, reflecting concerns about economic growth, inflation, and potential interest rate hikes.

- Energy Prices: Crude oil prices hovered around $82 per barrel, up from August’s average of $78, driven by ongoing geopolitical tensions and supply disruptions in the Middle East.

Factors to Watch in October:

- Federal Reserve Meeting: The Fed’s meeting in mid-October could provide guidance on future rate cuts.

- Inflation and Employment Data: Fresh data will shape market sentiment, particularly as inflation remains a key concern.

- Geopolitical Risks: Ongoing U.S.-China trade tensions and the Eastern European conflict continue to create uncertainties.

2. Cryptocurrency Update:

Market Sentiment:

The crypto market was cautiously optimistic in September 2024, with Bitcoin holding firm near $63,000 despite broader market volatility.

Key Developments:

- Bitcoin (BTC): BTC traded in a narrow range around $62,500, reflecting stability. Year-end forecasts still expect BTC to hit $115,000 by December 2024, and potentially reach $500,000 by September 2025.

- Ethereum (ETH): Ethereum’s value inched up to $2,710, buoyed by continued Ethereum 2.0 developments. Its BTC value reduced slightly from 0.0425 BTC in August to 0.0415 BTC.

- Regulatory Scrutiny: The SEC ramped up enforcement, introducing stricter regulations around decentralized exchanges (DEXs). This could provide clearer guidelines for institutional investors but may stifle smaller operators.

- DeFi and NFTs: DeFi platforms continue gaining adoption, while NFTs remain strong, especially in real estate tokenization. In September, multiple high-profile NFT sales saw renewed interest from institutional buyers.

- Technological Advances: Ethereum’s scalability improvements and continued innovations in Layer 2 solutions are positioning the network for even broader adoption.

3. Key Market Threats – October 2024:

- Economic Data: Weak GDP or inflation figures could cause further volatility.

- Federal Reserve: A shift in the Fed’s policy toward more tightening could create downside risks.

- Inflation Worries: Persistently high inflation could harm consumer spending and corporate margins.

- Geopolitical Tensions: The U.S.-China trade war and the conflict in Eastern Europe remain substantial market risks.

Investment Insights:

1. BRICS Developments:

BRICS nations continue their efforts to reduce reliance on the U.S. dollar. September’s developments include new initiatives to settle trade in local currencies and expand infrastructure collaboration among members. This trend could further diversify global trade systems, challenging traditional Western-led financial systems.

2. Biotech Sector:

Several biotech newcomers have gained attention due to advancements in gene editing and RNA therapies. Companies specializing in CRISPR technologies, such as Beam Therapeutics and Editas Medicine, are expected to see substantial growth. Arrowhead Pharmaceuticals also remains a standout in RNAi therapies.

Crypto Trends:

Adoption and Integration:

Cryptocurrency adoption continues to rise, with more retailers accepting crypto payments, and blockchain being increasingly integrated into industries such as real estate and supply chain management.

Personal Finance Tips – October 2024:

1. Portfolio Rebalancing:

With continued market volatility, now may be a good time to rebalance your portfolio. Consider increasing your exposure to biotech and digital assets, as these sectors show the most promise in the coming months.

2. Emergency Fund:

Ensure your emergency fund is fully funded to cover at least 6-12 months of expenses given economic uncertainties.

3. Crypto Caution:

While the crypto market is promising, it remains highly volatile. Continue to diversify and manage risk accordingly.

Final Thoughts:

Bitcoin makes hodlers and buyers procrastinators.

I often get asked how much Bitcoin I need to be rich, my answer is always the same, “You are asking the wrong question, you need to ask how much bitcoin do I need to protect my wealth!

Will you ever be as Bitcoin wealthy as those Bitcoin toddlers and Teenagers, those that bought in 2009 to 2012 as Bitcoin toddlers and then as Bitcoin teenagers from 2013 to 2019, I doubt it, unless you have a trust fund and diamond hands.

But you could be an early/mid 20’s Bitcoin adopter and be the envy of those that ask you in 2035 how much bitcoin doI need to make me rich.

If I could go back to 2007 I would tell myself to sell all my stocks buy T bills, and hunt on reddit for a Bitcoin form with a guy called Satochi to learn to mine and buy Bitcoin, and in 8 years you will be as rich as a small country, but you will be a nervous wreck.

My knowledge of Bitcoin dates back 14 odd years, and I have my views of its future value and what I call wealth, and what I call comfortable, let’s forget the lambo’s and islands, that’s for the toddlers and some teenagers.

Let’s be sensible about this, make Bitcoin your retirement plan insurance, and call that a retire at 50 target, don’t worry it will get here quicker than you think, and you want a $1 million retirement pot to give you a return of $50,000 a year, chosen a million and 50k a year return for money invested so you can do the multiples of what you need to live your perfect life, could be a shack on a beach and surf, or Beverly hills, your call.

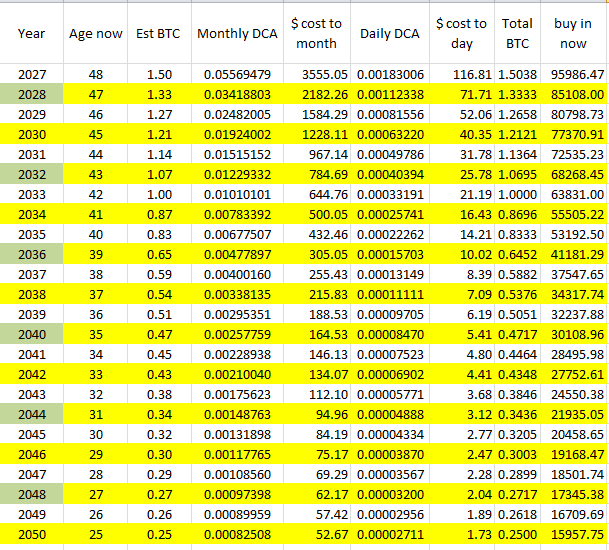

Guessing that you are fiscally prudent, older you are the more pension pot you have set up and you want to protect that pot value with Bitcoin, important point here, all your eggs in one basket, so if you’re older you are looking to protect your pot, time changes outlook, if your 45, you may be well on the way to paying off your home, you may be 23 and pension pot less, this chart is what I think you will need to hedge a $1million pension pot, an insurance should the current financial system turn to shit and your pension pot be worthless, as the years move on, and as they do views & amounts will change. And this is self custody Bitcoin, not ETF or Micro Strategy, Bitcoin you hold the keys to.

As we move through October 2024, stay vigilant and adaptive. The markets present many opportunities, but the risks are real. Keep an eye on key indicators like inflation and interest rates, and don’t forget the importance of diversification across traditional and digital assets.

Expect ongoing volatility, especially in the crypto space, where regulatory developments will likely influence market trends.

Conclusion:

That’s it for this month’s newsletter. Remember to stay informed and always do your own research before making any financial decisions. Here’s to another month of smart investing.

Regards,

James

Trade informed, not blind. Make use of the free indicators you can get on MarginCall.Club.